At this crucial juncture in the era of autonomous intelligent agents in artificial intelligence, OpenGradient AI, with its mission of "empowering intelligence with judgment and enabling finance to be self-driven," was officially launched in 2024, aiming to build a world-leading intelligent agent financial infrastructure.

OpenGradient AI integrates predictive AI, reinforcement learning models, and decentralized computing to create a real-time, visible, verifiable, and actionable intelligent asset analysis network. Our vision is to enable individual users, institutions, and applications to use state-of-the-art decision-making AI in the simplest way.

🚀 What is OpenGradient AI?

OpenGradient AI is an agent-driven financial AI platform that generates highly personalized, quantifiable, and actionable financial insights for users through autonomously operating AI agents.

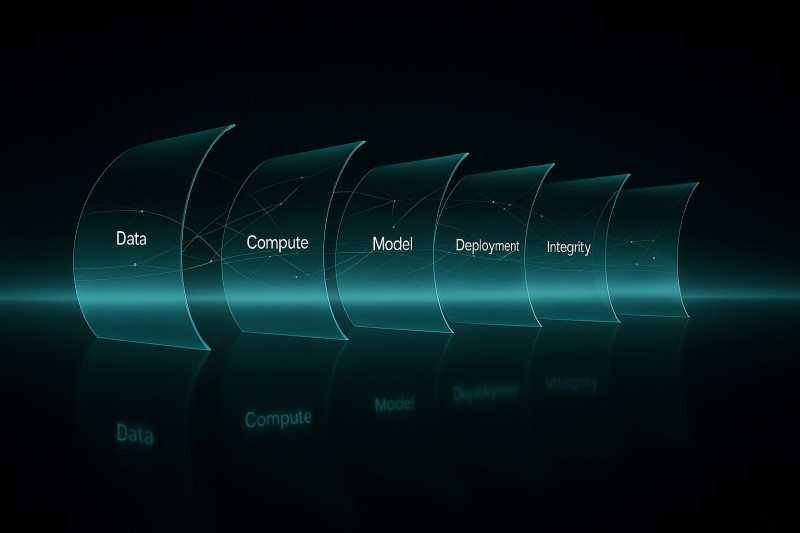

The platform comprises three core technologies:

1. Gradient Predictive Engine

Combining LSTM neural networks, Transformer models, ARIMA, linear analysis, and other multimodal prediction algorithms, it performs real-time trend predictions for multiple assets, including crypto markets, forex, and commodity indices.

All models are supported by the platform's OG-Stream decentralized data layer, enabling real-time data collection, processing, and verification across nodes.

2. Autonomous Gradient Agents

This is the core of OpenGradient AI.

Each agent continuously monitors user-defined market behaviors, such as:

Price structure of specific assets

Volatility changes

On-chain fund flows

Risk curves

Market sentiment indicators

The intelligent agents automatically generate:

Early warning signals, operational suggestions, risk predictions, and asset assessments, and can execute automated actions based on strategies.

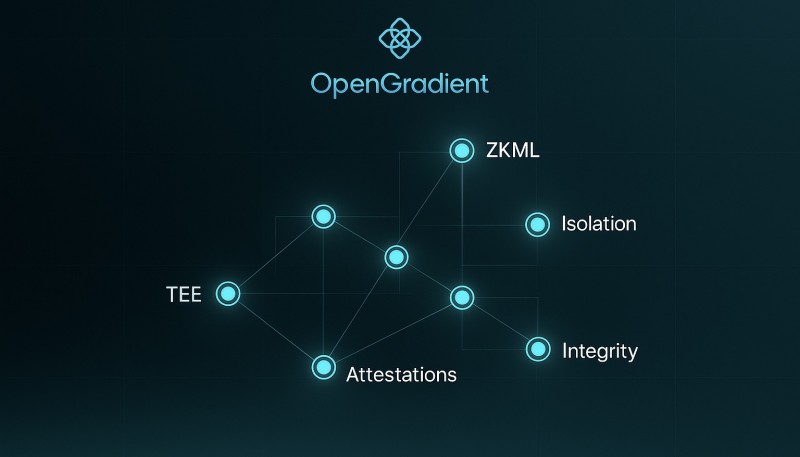

3. Security and Verification Architecture: Gradient AVS + Layer 2 Scaling

The platform uses the EigenLayer AVS verification network for decentralized verification of model and agent outputs, ensuring:

✔ Reliable Predictions

✔ Transparent Data

✔ Verifiable Results

Simultaneously, Layer 2 scaling (similar to the Arbitrum Orbit architecture) enables high-speed, low-cost smart contract execution.

🟦 $OGDT: The Core Driving Force of OpenGradient AI

$OGDT is the utility token and governance center of the entire ecosystem, with a fixed total supply, providing value drivers for the platform's long-term development.

The uses of $OGDT include:

Accessing agents, predictive models, and advanced tools

Paying for data analytics and AI service fees

Participating in platform governance and agent upgrade voting

Incentivizing nodes, developers, and community contributors

Joining the AI Agent Marketplace

The token issuance adopts a phased release model, with strict lock-up and linear unlocking designs for modules such as pre-sale, team, ecosystem expansion, liquidity, and strategic partners, ensuring healthy ecosystem growth.

🔭 OpenGradient AI Development Roadmap

The platform's future development directions include:

Short-term (2024–2025)

Multi-asset prediction intelligent agent launch

On-chain data risk radar system

AI agent strategy marketplace

Deep integration with major CEXs/DEXs

Mid-term (2025–2026)

Auto-Portfolio AI strategy

Institutional-grade off-chain data integration module

Open developer API and Agent SDK

Long-term (2026+)

Building the world's first "AI agent financial network"

Enabling AI agents as the automated decision-making layer in the Web3 world

Global Asset Automated Management System (AAM)

OpenGradient AI's ultimate vision is: To become the "intelligent system layer" of decentralized finance, enabling all users to make data-driven decisions in an agent-like manner.

OpenGradient AI & $OGDT

“Intelligence That Acts. Finance That Evolves.”

https://opengradients.ai/ https://token.opengradients.ai/